How Credit Score Affects Your Mortgage Rate

Your credit score is a judgment about your financial health, at a specific point in time. It indicates the risk you represent for lenders, compared with other consumers.

Your credit file is created when you first borrow money or apply for credit. Regularly, companies that lend money or issue credit cards to you — including banks, finance companies, credit unions, and retailers — send specific factual information related to the financial transactions they have with you to credit reporting agencies.

When you apply for a new loan, the loan officer will check your credit history first. Your credit score in most cases influences the amount you can borrow and also your interest rate. Understanding your credit score in a better way enhances your chances to develop a higher score and thus benefit from loans at better terms and conditions.

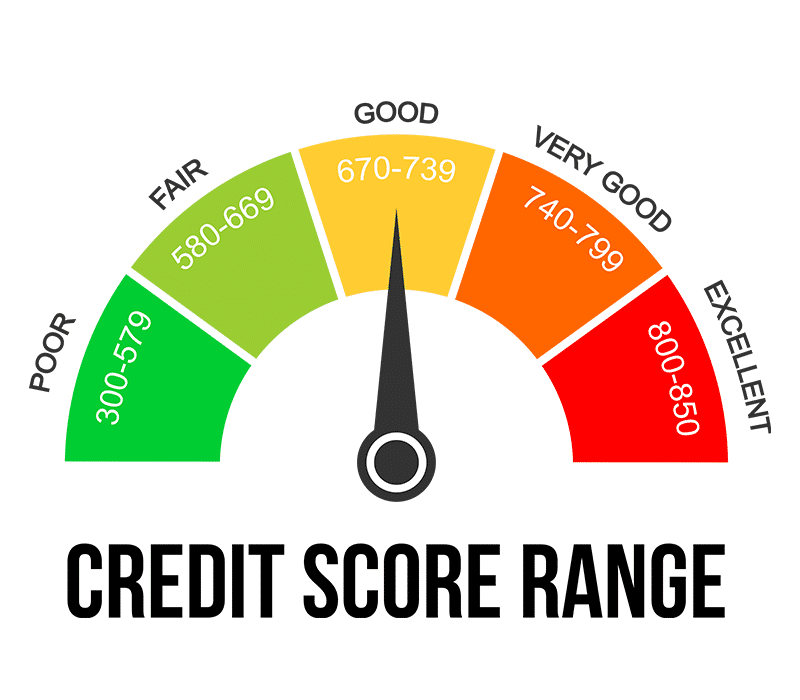

A credit score is calculated from many different factors: your payment history, your credit card balances, bank accounts, savings and chequing accounts, and any other form of credit including all outstanding personal loans, mortgage loans, store credit cards, etc. Each credit reporting bureau has its own standards and formulas that they use for the purpose of calculating a consumer’s credit score. The following is a generalized classification of a credit score rating:

Excellent credit rating - No late payments, no collection notices, no bankruptcies or repossessions.

Good credit rating - This may contain a late payment within the last two years.

Fair credit rating - More than one late payment. May or may not have a bankruptcy or repossession in the last two to three years.

Poor credit rating - Recent collection attempts, late payments within the last year, bankruptcies, and/or repossessions within the last two to three years.

The reason why a credit score is important is that it will determine your eligibility for a loan. A low credit score may hinder approval, and it will also impact the interest rate you will have to pay for the money that you borrow.

Since individuals with less-than-perfect credit traditionally present more of a risk of defaulting on a loan, lenders are able to justify charging more interest to those consumers. The extra interest the lender earns on the loan is intended to compensate the lending agency in the event the consumer defaults on the loan. Over the course of a 15 or 30-year mortgage, those extra interest points can add up to an astounding amount of money.

Your credit score is an indication of your financial health. You should do your best to avoid damaging your credit history with late or missing payments, too many outstanding loans or too many loan requests. Watching your credit score closely especially before you make any major purchases will help you avoid unwanted surprises.